A business is said to be resilient when it has the ability to quickly adapt to disruptions while maintaining flow of operations and safeguarding people, assets and overall brand equity. In simple terms, it means that when disruption occurs, there are mechanisms in place to absorb the hit without incurring significant damage to the overall business.

In the face of a crisis, resilient organizations remain stoic and steadfast instead of being overpowered by it. The COVID-19 pandemic has had a catastrophic effect on people, businesses and economies around the world. Many companies have realized that having a resilience plan in place helps them to better mitigate, prepare for, respond to, and recover from emergencies.

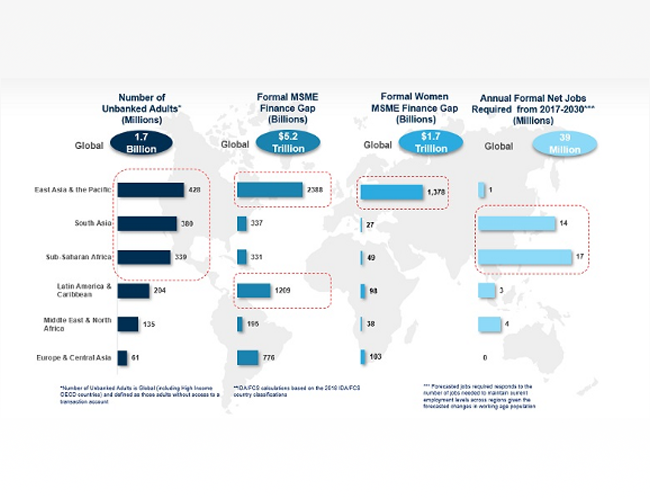

Micro, small and medium enterprises (MSMEs) are widely recognized for their important contributions to development by stimulating economic growth, creating decent jobs, eradicating poverty and improving livelihoods, especially in developing countries.

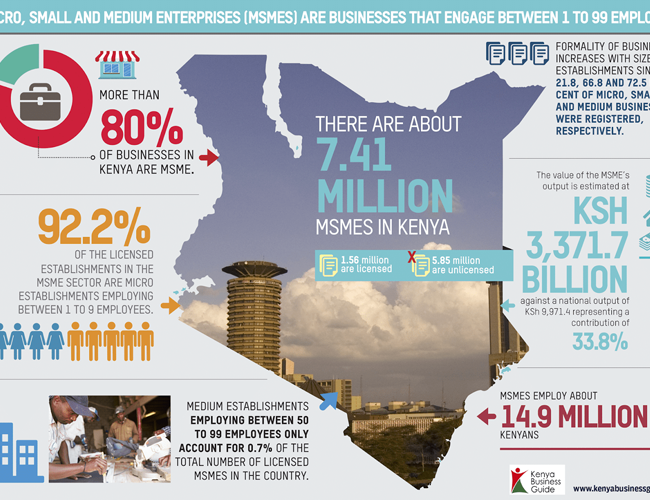

Although it is estimated that formal SMEs contribute up to 40 per cent of the national income (GDP) in emerging economies, the International Finance Corporation (IFC) estimates that globally, 74 per cent of MSMEs are informal. In Kenya, there are currently 8 million MSMEs, employing at least 15 million Kenyans. Additionally, 80% of all businesses in Kenya are MSMEs, highlighting the crucial role MSMEs play in Kenya’s economy.

The pandemic has had a devastating impact on MSMEs globally as they are vulnerable to economic shocks linked to reduced access to credit, reduced customer demand among other challenges they currently face. There also exist other factors that exacerbate their vulnerability in the midst of a raging pandemic

Both recovery and business continuity are important elements to ensure that the impact from the crisis on MSMEs is minimized and that resilience is enhanced. It is critical now more than ever to support MSMEs as they often lack the support they need to resist prolonged disruptions.

MSMEs happen to be more vulnerable to disruptions than larger firms, as they may have limited access to effective risk management frameworks. Furthermore, MSMEs in emerging markets or developing nations deal with more constraints in the event of a major disruption such as

- an abrupt drop in demand

- working capital issues

- logistics disruptions

- medium-long term disruption of business models in certain sectors, and

- a significant loss of livelihoods and income

MSMEs have been facing unprecedented income losses and uncertainties about their future because of business disruptions due to the outbreak of COVID-19. The Central Bank of Kenya warned a major collapse of these businesses as they do not have the liquidity needed to continue operations and do not have financial reserves to meet expenses during emergencies. According to a BFA Global study, Only 39% of Kenyans have set aside funds to manage emergencies that arise from loss of income.

MSMEs often don’t have a business continuity framework in place like bigger companies. However, understanding the disaster risk and taking precautionary measures could help to mitigate many of the risks and help the MSMEs to bounce back after a disaster strikes.

At PesaKit, we continue to support mobile money agents in various ways to assist these MSMEs adapt their operations to the new environment. These methods not only strengthen their odds of surviving the crisis, but will ensure they emerge more resilient in a sustainable and inclusive manner.

We enable mobile money agents to maintain regular and consistent cash flow by diversifying the financial products and digital commerce services at agents’ locations. Additionally, mobile money agents can use the PesaKit platform to access a “Float Exchange”. This allows agents to purchase float remotely from their shops, reducing their need to frequent banks, and build their capacity to meet their customers deposit/cash-in needs. By providing agents with access to credit, we facilitate business growth, increased income, decent job creation and catalyze entrepreneurship.

We also launched a safety and misinformation campaign on the best practices to prevent the spread of COVID19 at agent shops using communication materials such as posters, pamphlets, SMS and videos. Through these materials we aim to educate mobile money agents and their customers on best practices to prevent spread of COVID-19 at agent shops ensuring safe and secure DFS locations.

And finally, we introduced a COVID-19 insurance scheme that mitigates the adverse outcomes associated with COVID-19 related health shocks supporting them to rebuild when disaster hits. The scheme offers agents a 12-month hospitalization cash insurance cover that provides them with an income safety net in the event they test positive, are quarantined or admitted to a hospital due to COVID-19.

The MSME pillar in Kenya is recognized as a key driver of growth and the lack of resilience in these businesses is a cause of great concern. Therefore, it is imperative that MSMEs be equipped with the tools and know-how on how to survive a sudden and abnormal disruption of this magnitude and its business models should be retailored to enable adaptation, mitigation and continuity.

PesaKit serves a network of mobile money agents across Kenya (and soon Tanzania), the majority of whom run microbusinesses of their own in addition to their mobile money businesses. We understand the importance of building their financial resilience and their financial health, especially because of the interconnectedness between their household finances and the businesses themselves. Our goal everyday is to empower mobile money agents to be at their most effective. Because, when mobile money agents thrive, we all thrive.