Contributed to DFS Lab Blog by Andrew Mutua, Founder of PesaKit

Kenya is a global leader when it comes to mobile money services. In 2007, the telecom operator Safaricom launched its mobile money service M-Pesa as a simple way to text small payments between users. A decade later, the platform enables almost 30 million people to pay for crucial services, access loans, and send money all over the world. M-Pesa has become the world’s most successful mobile money service.

Digitizing and disbursing cash is enabled by a network of physical access points, or agents. In most cases, an agent is the most convenient way for customers to deposit or withdraw cash from their mobile money accounts.

Even with the M-Pesa revolution, digitizing and disbursing cash still has inherent limitations. The majority of agents consistently turn away customers because they don’t have sufficient e-float with a mobile money provider to facilitate a deposit transaction or enough cash to facilitate a withdrawal transaction. Additionally, agents incur a high cost of maintaining liquidity during e-float top-ups and fragmentation of the agent e-float if an agent is serving multiple providers which results in increased cash-flow pressure.

In Nairobi, Kenya, there’s a new kid on the block. PesaKit. PesaKit’s mission is to empower every mobile money agent on the planet to achieve and deliver more.

PesaKit is focused on agents because they are a core part of the operational infrastructure of mobile money. According to the GSMA state of the industry 2016 report, agents represented 94.8% of mobile money’s physical cash-in and cash-out global footprint whereas ATMs represent just 4.2% and bank branches represent 1.0%. In December 2016, 30 markets had 10 times more active (30-day) agents than bank branches. The expansive reach of agents is a hallmark of mobile money; with more than 4.3 million, or approximately 1.2 agents per 1,000 adults, of which 2.3 million are active.

For every 100,000 adults in Kenya, there are 11 ATMS, 6 commercial bank branches and 538 mobile money agents. This prompted Andrew Mutua, Founder of PesaKit, and his team to conduct a qualitative study to examine the potential of machine learning-based liquidity recommendations to help mobile money agents manage and improve their operations.

The study conducted in May and June of 2017 begins in Nairobi’s Dandora estate, a sprawling low-income residential area. It hosts the largest dump site in Kenya and one of the most dangerous informal settlements in Nairobi. We meet Tobias Okusimba, in an 18sqft partition of his 100sqft home where he runs his mobile money agency business offering M-Pesa and Airtel money services. He also vends consumer durables. He has been an agent for the past two years, open 12 hours a day, six days a week. His primary motivation to start the agent business was to earn transaction commissions.

With a transactional value of nearly Kshs 40,000 ($400) per day he has to convert cash to e-float daily. This means walking a kilometer to the nearest bank. He fears insecurity during transit to the bank and running out of e-float during business hours.

We interviewed and collected data from four more agents in Nairobi then moved to Thika and Bomet, two other towns in Kenya.

225 KMs Northwest of Nairobi is Bomet — a bustling, fast growing, rural, agricultural town. There we meet Daniel Mugambi, owner of Classic Mobile Solutions, located at the heart of the town. His shop is illuminated by the various television screens displayed on the shelves along with other electronics and telecommunication products. He says business in the area is great, especially during harvest seasons. His mobile money business is a complimentary revenue generator. However, to extend his business reach and expand his customer base, he decided to open another electronics shop and mobile money agency some 25 kilometers away in a town called Mulot. Most of his customers are residents of the larger Bomet County from the agricultural farmlands. His main setbacks are e-float management and overseeing the shop in Mulot from afar.

Our findings

Through our study we aimed to understand the urban and rural agent profiles. What are PesaKit’s agent training and educational needs since we are using a smartphone app which is different from the common SIM toolkit agents use? How can PesaKit resolve the agent’s liquidity problems? What do they do when their e-float is depleted? How often do they use the top up and top us method? Can agents use an app to manage their operations? What is the value they see in PesaKit? Who are competitors and alternatives to PesaKit’s service? How do we validate our user interface design and app experience?

In total, we engaged 16 agents. Some of the patterns we observed from our study were:

- 70% of the mobile money agents interviewed have more than one agent location.

- 50% have a working capital between Kshs. 50,000 — Kshs. 100,000 ($500-$1,000).

- 40% of the agents do transactions in the range of 40–60; 30% do transactions in the range of 20–40; 20% in the range of 10–20; and 7% do between 60–100, while 2% do above 200 transactions per day.

- 60% of our respondents said the major challenge they face is the depletion of float; 20% said the major challenge is fraudsters; 10% say it is inadequate customers, while 5% list low commissions as their major challenge.

- 80% of the agents said their major motivation to be an agent was the transaction commissions while 10% said that it is a strategy to attract more people into their stores and shops.

- 50% of our respondents have a smartphone and have used mobile banking or mobile applications before. This indicates our smartphone based model would reach at least half the market.

- 70% of our respondents would consider borrowing float from PesaKit while another 20% would use the merchant services.

- 90% of the mobile money agents that we interviewed did encounter issues with their float being depleted daily, meaning they miss revenue opportunities on a daily basis.

- 100% of our respondents would love to receive liquidity management recommendations.

E-float data overview from some of the participating agents

Source: Compiled by the author (2017)

Transactions and e-float relationships

E-float after withdrawal transactions:

When the agent performs a customer withdrawal transaction, the rise in e-float value indicates the amount being withdrawn or sent by the customer from their mobile money account into the agent’s account and in return the agent gives the customer cash.

E-float after deposit transactions in June:

When the agent performs a customer deposit transaction, the decrease in e-float value indicates the cash being deposited, or given to agent, by the customer to top up their mobile money account and so the agent’s e-float is deducted and sent to the customer’s account.

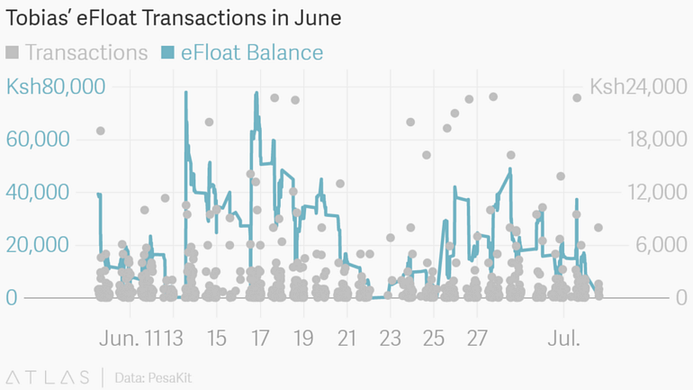

Graph 1

The graph below shows the changes in e-float as the agent performs withdrawal, deposit and e-float top up transactions during the month.

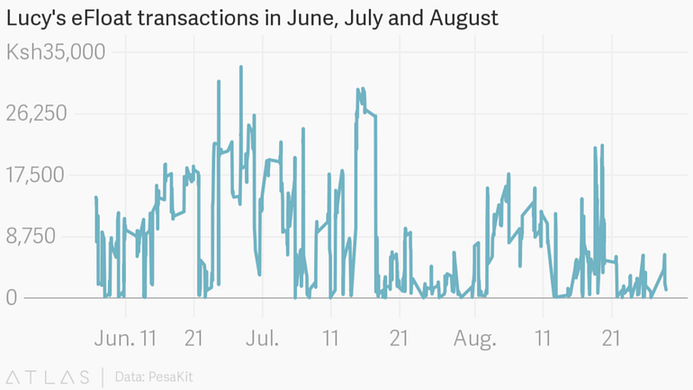

Graph 2

The graph below shows the transaction points where e-float is affected.

Graph 3

We observed one of our agents for three months (June, July and August) and witnessed similar patterns. Her e-float went below Ksh 1,000 (Approx $10) 97 times.

What is PesaKit?

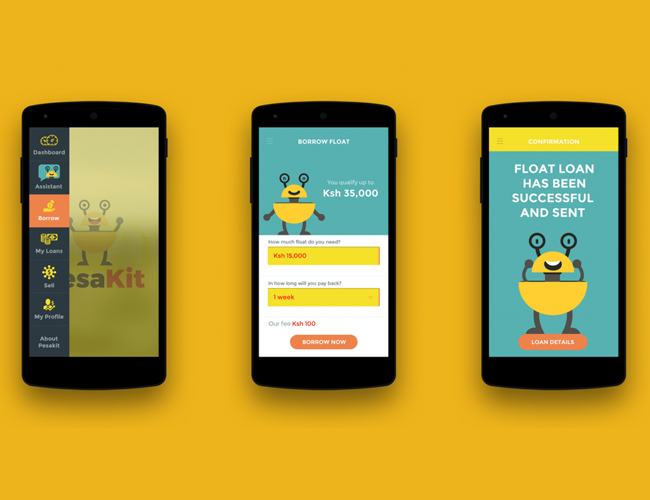

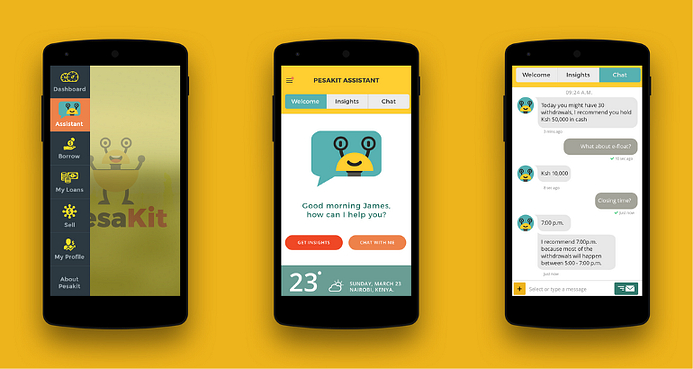

PesaKit is an AI powered digital/robo assistant for mobile money agents. It helps agents to know, manage, and control their liquidity (e-float and cash) through predictive analytics by forecasting their inventory needs for the next hour, day, week or month.

The agent’s experience

90% of the mobile money agents that we interviewed get their e-float depleted daily and have to turn away customers. This is an inconvenience to the customer, and a missed revenue opportunity and reputational risk to the agent.

We shared the PesaKit app prototypes with agents showing the different features available. Most agents liked the simplicity and intuitiveness of the app. They requested a Swahili version of the app. Two features dominated most of the conversations, the robo assistant and borrowing e-float.

All the agents loved the robo assistant with its various recommendations or insights. The recommendations are simple text styled messages, like how much e-float or cash an agent needs, projected customers and much more. They also appreciated the interactivity; being able to ask questions and getting advice in real time.

From the study, 70% of the agents said they would consider borrowing e-float from PesaKit. They appreciated PesaKit scoring and seeing the amount they qualify to borrow. This gives them peace of mind knowing they have e-float on-demand. They loved that the fees are clear and easy to understand.

Creating value through data

PesaKit’s ability to continuously transform mobile money agent data points to valuable and actionable insights will enable the agent to improve their operations, reliability, credit-worthiness and profitability resulting in enhanced convenience, better financial services and lower costs for unbanked poor and under banked low income earners in urban and rural areas.

To learn more about PesaKit, visit www.pesakit.co.ke or email; andrew@pesakit.co.ke

PesaKit’s study was aided in part by Digital Financial Services Innovation Lab (DFS Lab), a Bill & Melinda Gates Foundation-backed accelerator that supports fintech startups in the emerging markets of South Asia and sub-Saharan Africa.