Digital Financial Services (DFS) have become a transformative tool for financial inclusion, offering a pathway to economic empowerment for underserved communities around the globe. By leveraging technology, DFS breaks down barriers that have historically excluded populations from traditional financial systems, fostering economic growth and supporting sustainable development.

Expanding Financial Access

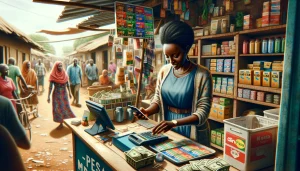

In many developing regions, limited infrastructure and high service costs have long prevented individuals from accessing formal banking services. However, the advent of mobile money and digital payment platforms has revolutionized this landscape. As of 2021, the share of adults making digital payments in low- and middle-income economies doubled from 26% in 2014 to 51%. This shift represents a significant move toward financial inclusion, enabling people to engage in digital transactions without the need for physical bank branches. Through these digital tools, financial access has become more affordable, convenient, and widespread.

Enhancing Economic Participation

The benefits of DFS extend beyond mere access to financial services—they actively contribute to economic participation. With tools like mobile wallets and digital lending platforms, individuals and small businesses are now empowered to take part more fully in the economy. For example, digital credit services provide microloans to entrepreneurs who may not have the collateral necessary for traditional bank loans, promoting business growth and income generation. However, challenges remain. In countries such as Kenya and Tanzania, the rise of digital credit has been accompanied by issues like late repayments and defaults, particularly among vulnerable populations. This underscores the importance of responsible lending practices and tailored solutions that account for the unique needs of these communities.

Empowering Women and Marginalized Groups

DFS also plays a pivotal role in empowering women and marginalized groups. Financial inclusion gives women the tools to control their finances, invest in businesses, and improve household welfare. Mary Ellen Iskenderian, president and CEO of Women’s World Banking, highlights the critical need to bring nearly one billion unbanked women into the financial system. She points out that women entrepreneurs in developing economies often face significant funding gaps, and DFS can help bridge this divide. By providing women and marginalized groups with greater access to financial resources, DFS unlocked opportunities that were previously out of reach.

Building Trust and Financial Literacy

For DFS to be effective and sustainable, building trust within underserved communities is crucial. Many individuals lack the necessary financial literacy to make informed decisions about their money, which can hinder the adoption of digital financial services. This is where education and transparency come into play. Financial literacy programs and clear communication about how digital platforms work can empower users, ensuring they feel confident in using these services. Trust-building is key to encouraging long-term adoption and ensuring that DFS becomes a stable part of individuals’ financial lives.

Driving Sustainable Development

Beyond immediate financial access, DFS plays a role in supporting broader sustainable development goals. With tools like credit, savings, and insurance, DFS enables individuals to make investments in education, healthcare, and entrepreneurship, all of which contribute to a higher quality of life. Vulnerable groups—such as low-income individuals and farmers—particularly benefit from these services, which offer them a way to manage risk and enhance productivity. By facilitating reliable, efficient financial transactions, DFS helps communities build resilience against economic shocks and promote long-term development.

Conclusion

In conclusion, Digital Financial Services have the potential to reshape the economic landscape for underserved communities by providing accessible, affordable, and secure financial solutions. Through enhanced financial access, greater economic participation, empowerment of women and marginalized groups, and support for sustainable development, DFS are helping to pave the way toward a more inclusive and prosperous future. To ensure this progress continues, it’s essential that DFS evolve responsibly, remain adaptable to local needs, and be accessible to all, driving the global goal of financial inclusion.