The world is still reeling from the effects of the various COVID-19 variants; socially and economically, things have dramatically changed in the last 2 years. In this article, we shall analyze the specific impact of coronavirus on employment, salaries &MSMEs in Kenya and how some MSMEs have coped.

Employment

Employment by private sector firms fell by 16% between March and April of 2020 as the Government enforced containment measures to stop the spread of the virus. Of all the big economic sectors in Kenya i.e manufacturing, trade, agriculture, finance, hospitality and transportation, the most severe impact has been felt in the hospitality and transportation sectors.

The private sector was first impacted by disruptions of the supply chain and trade with China in early 2020. The most significant logistical challenge reported by firms in a Kenya Association of Manufacturers’ report was an increase in sea freight costs followed by delays in the supply of imported raw and intermediate materials used in local production. The increased demand for imported goods by the United States economy, particularly from China meant supply chain processes elsewhere experienced significant delays and increased costs. This led to 41% of the surveyed KAM membership including Chief Executive Officers, Managing Directors, Chief Operating Officers, Operations and Finance Directors downsizing their workforce.

In mid-March, the Kenyan Government closed national borders, restricted domestic travel, banned public gatherings, closed schools, and later imposed a night-time curfew. Additionally, strict lockdown measures were put in place for the most at-risk counties in April.

By April 2020 overall formal employment fell by 16% and the overall payroll dropped by 10% between March and April 2020. After April, employment numbers in all sectors experienced a steady decline as the financial impact of Covid-19 was felt across most companies’ bottom lines.

Employment in the hospitality and tourism sector started to decline in March and by April 2020, employment levels across all sectors also dropped. Companies in accommodation, food services and tourism activities on average saw a decline in the number of employees of close to 10% in April 2020. By May 2021, the employment level in Kenyan hotels was at 57% of the number of employees in February 2020, when the level was at 100%.

Without international tourists due to travel restrictions the tourism sector mostly catered to domestic activity which was also limited as a result of lockdowns in the country and reduced appetite for luxury spending on non-essential items by most Kenyan families.

According to the Kenya National Bureau of Statistics (KNBS), 1.7 million jobs were lost in the formal sector in 2020. A year later, a May 2021 Federation of Kenyan Employer’s report found that over 5 million people lost their jobs in the informal sector. This growing statistic has been devastating for many households who have seen the primary bread-winner get laid off work.

Salaries

Companies raised average monthly pay by 3.82% to Sh67,490 in the year ended June 2020, a steep drop from the 8.16% raises to Sh65,006 the year before. That was the slowest rise in earnings since 2011 when firms raised average pay by 3.48% and nearly half the average 7.41% in the decade before last year.

Employers warn that it may take years for pay raises to return to pre-pandemic levels, with firms struggling with elevated costs largely due to uncertainties brought about by Covid-19. The Federation of Kenya Employers (FKE) said persisting instability in global supply chains and increasing global oil prices had saddled firms with a high cost of materials and further raised the cost of operation.

A survey, commissioned by the Kenya National Chamber of Commerce and Industry (KNCCI), suggests 67.2% of surveyed traders faced challenges in paying workers at the end of 2020 compared with 35.3% before the pandemic hit. Over 37.9% of small businesses were having trouble retaining workers at the end of 2020 compared with 20.9% at the beginning of the year.

The survey, done in partnership with the Center for International Private Enterprise (CIPE), is based on feedback from 153 businesses with monthly sales of between Sh500,000 and Sh5 million in 40 counties. Small businesses with a turnover of between Ksh500,000 and Sh5 million per month provide the majority of employment opportunities which keeps the cash flowing in all sectors. When these businesses are hurting, the impact is felt in all areas of the economy according to KNCCI president Richard Ngatia.

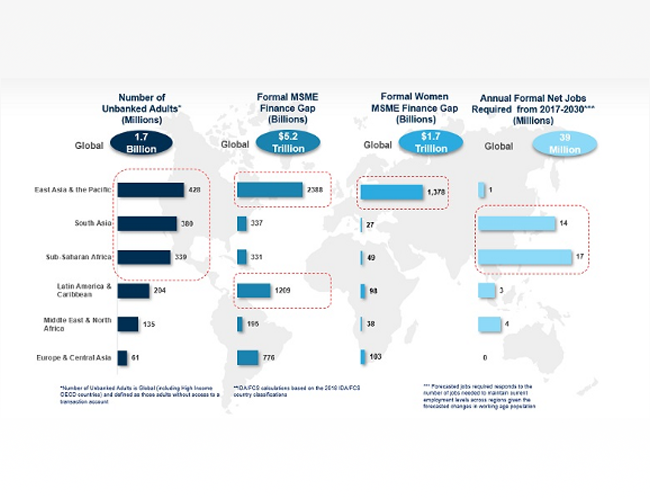

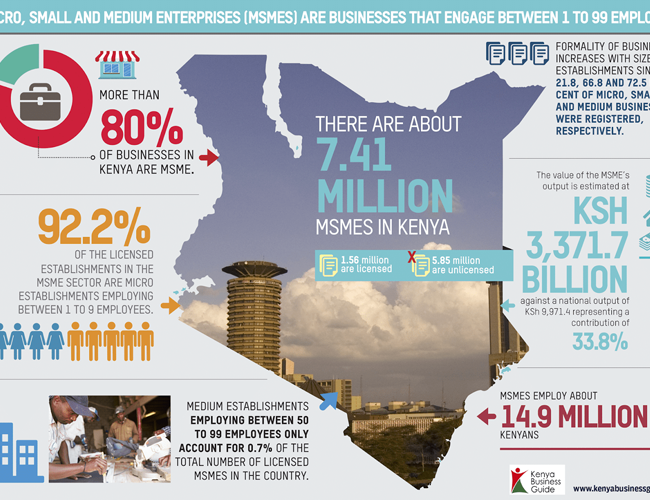

MSMEs

The MSME sector has been severely impacted by COVID-19 with early containment measures by the Government. Work has become quite difficult for people unable to perform their normal functions while abiding by social distancing and other public health practices. Small retailers who were unable to conduct business without the risk of exposure and infection faced reduced demand for their services and goods, shrinking the industry further. One of the biggest challenges of MSMEs was that most of their processes were manual and that employees were required to appear in person in their areas of work exposing themselves to the risk of covid.

In the wake of increasing financial difficulties faced by MSMEs in accessing credit and keeping business afloat, the Central Bank of Kenya stepped in to provide borrowers with various restructuring options including extensions of the repayment period, a moratorium on principal or interest and waivers on interest or fees. These provided space to borrowers to ride through the pandemic, mitigate job losses and pivot their business models to the new normal.

44% of the 2,739 respondents in a Georgetown University survey reported that someone in their household had lost a job due to the pandemic. Of these, two-thirds reported the loss as temporary, while one-third said the loss was permanent. 86% of the retailers reported that the curfew had affected their source of income because they were forced to close their shops early or open later than normal.

65% of respondents reported that cessation of movement had negatively affected their commercial operations. The impact of the pandemic was felt in households across the country as nearly half of the respondents reported small increases and an additional 9% reported large increases to prices of essential commodities. 38% of retailers reported having taken out formal loans from financial institutions, while 29% accessed informal loans from relatives and friends to deal with the effects of the pandemic. 18% of respondents took out both informal and formal loans with the credit crunch biting most MSMEs. Very few families received any form of relief from the government with measures like tax relief for individuals earning a gross monthly income of up to KSh 24,000, a reduction in personal income tax rate from 30 to 25% and a reduction in the corporate income tax rate from 30 to 25% not impacting most MSMEs.

NGOs, religious organizations, family or friends and private individuals supplemented efforts by the Government to give cash relief bailouts by buying household commodities for affected communities.

Braving the Storm

Kenyan MSMEs showcased their resilience and innovation by making use of digital technology to survive and thrive in the tough business environment caused by the pandemic. MSMEs with higher digital maturity reflected lower levels of negative impact on income. The use of fintech has been key for marketing products and services, development of products and services, procurement, financial management and customer care. The use of tools such as social media, e-commerce platforms and websites have enabled MSMEs to access wider markets.

Covid fatigue has affected many people in Kenya over the last two years with doom and gloom being the only outlook but hope is on the way. The World Bank predicts that the Kenyan economy could grow by 5% by the end of last year. This projection is based on firms boosting industrial production and investments as lockdown measures are lifted, a slight recovery in the services sector due to vaccinations, and adequate crop harvests. Kenyans are resilient people and though knocked down, we are not knocked out. We look forward to a brighter 2022 and hopefully an end to the Covid pandemic.