Credit Reference Bureaus (CRBs), are institutions which collect credit information about borrowers who may be businesses or individuals. By observing the repayment of past and current borrowed loans, they gauge business’ and individuals’ credit standing and worthiness.

Credit Reference Bureaus (CRBs), are institutions which collect credit information about borrowers who may be businesses or individuals. By observing the repayment of past and current borrowed loans, they gauge business’ and individuals’ credit standing and worthiness.

A CRB listing can either be positive meaning one is repaying their loans on time or negative where an individual is defaulting. The ultimate negative listing is a ‘blacklisting’, this is given when CRBs deem one a high risk and advise financial institutions against providing the blacklisted lender with any credit. This is as a result of assessing the individual’s credit report containing their credit history and activity.

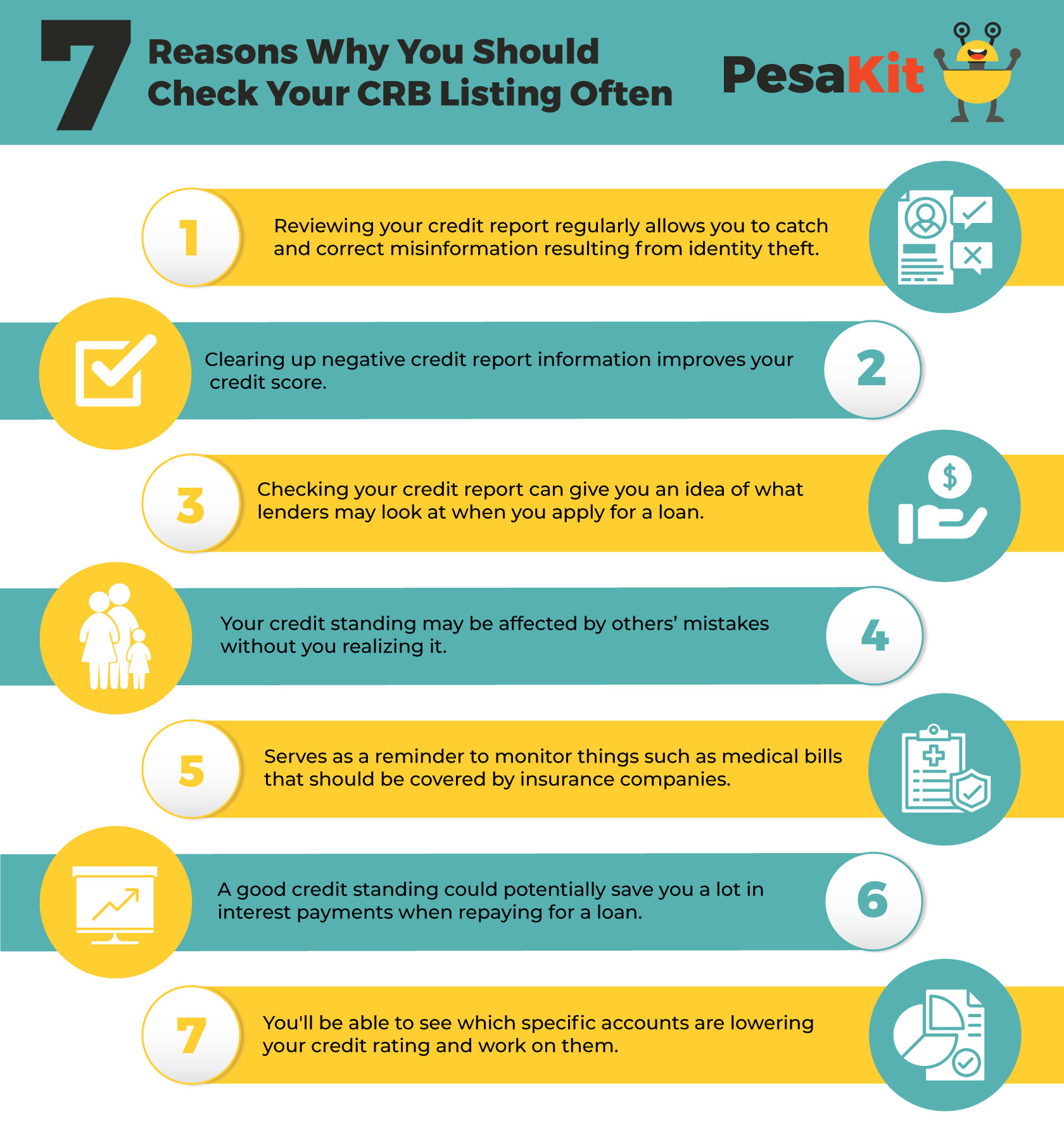

So why should you check your CRB listing often?

- Reviewing your credit report regularly allows you to catch and correct potentially damaging personal and financial information resulting from identity theft, errors, or outdated entries. Resolving mistakes early avoids problems when you apply for a loan or for a job at a potential employer.

- Clearing up negative credit report information will improve your credit score. This would increase a lender’s confidence that you repay on time and thus may help you qualify for loans of lower interest rates and longer repayment periods.

- Know what lenders may see. If you’re planning to borrow a large amount of loan or an emergency loan, checking your credit report can give you an idea of what lenders may see when you apply for credit. If your report contains errors, it may affect your credit and take long to correct. You don’t want to delay resolving these issues, especially when applying for emergency loans.

- Your credit may be affected by others’ mistakes. Even if you pay your loans on time, the human factor in some of the lenders’ application process may lead to data errors that could hurt your loan application and you may not realize it. Additionally, if you are the custodian or a cosigner of your child’s bank account or a mobile money account and they are late on repayments, your account may take a hit. Knowing where the error is helps resolve it quickly and rebuild your own credit.

- Checking your credit report serves as a reminder to monitor things in your financial accounts that might usually escape your notice, such as paying for medical bills that are supposed to be covered by insurance companies.

- You will enjoy a lower cost of borrowing by being proactive about your credit. Good credit scores could potentially save you a lot in interest payments. This way, if you apply for a loan, you won’t have to scramble at the last minute to dispute errors with a risk of being charged higher interests by the lender.

- If you have poor credit, reviewing your credit reports can help you figure out how to rebuild it. Instead of guessing where you’re going wrong, you’ll be able to see which accounts are lowering your score and work on them.

Now that you know how important it is to check your CRB listing regularly, when was the last time you performed a check? Download the PesaKit app now and get to know if you have been blacklisted by CRB!